- Order Volume increased 61% YoY to record high $4.92 million

- Gross Profit increased 61% YoY and reported Gross Margin increased to 63%

- Partnerships with athletes and leagues continue to drive order volume and sales growth

Toronto, Ontario (October 28, 2024) – American Aires Inc. (CSE:WiFi; OTCQB:AAIRF) (“Aires” or the “Company”), a pioneer in cutting-edge technology designed to protect against electromagnetic field (EMF) radiation and optimize human health, announces filing its Q3/2024 results on https://www.sedarplus.ca. Unless otherwise indicated, all dollar amounts are reported in Canadian dollars.

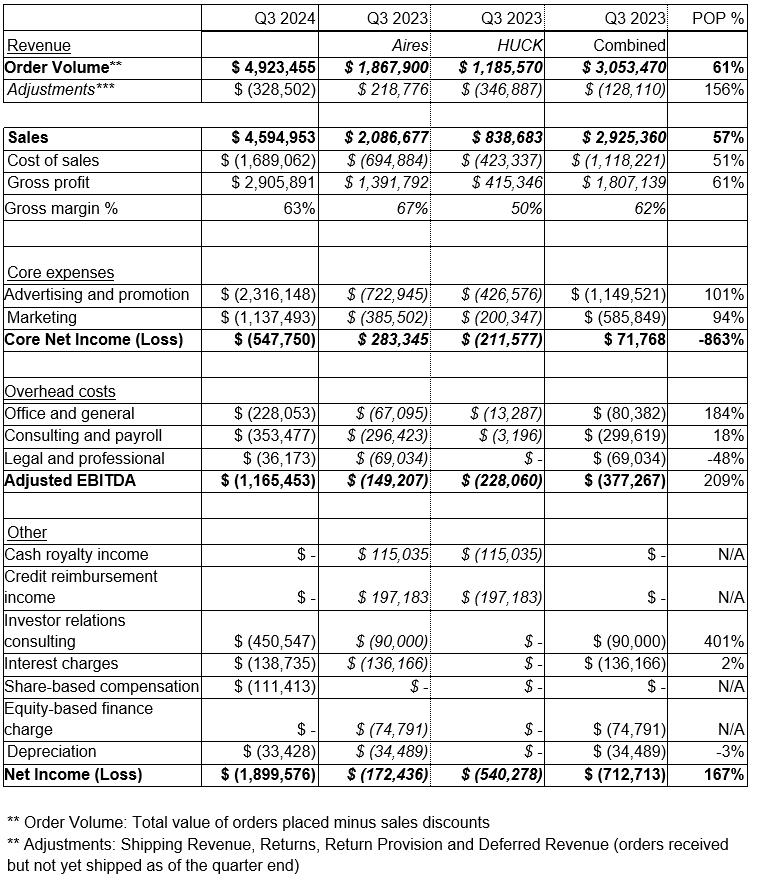

During the three months ended September 30, 2024, Order Volume (total value of orders placed minus sales discounts) increased by 61% YoY to an all-time Company record of $4.92 million. After taking into account relevant accounting Adjustments (Shipping Revenue, Returns, Return Provision and Deferred Revenue), the Company’s reported sales increased by 57% YoY to a record of $4.59 million compared to the combined non-IFRS sales of $2.92 million a year ago. The quarter’s increase in order volume and reported sales was driven largely by the efficient deployment of scaled-up advertising and marketing budgets, which included strategic partnerships the Company entered into during Q2 and Q3 2024 with the UFC, NHL Captain John Tavares, Canada Basketball, NBA star RJ Barrett, and the WWE. The quarterly performance extends the Company’s multi-year trend of strong revenue growth through widening its user base, opening new market segments, and expanding its overall reach and brand name recognition.

Cash as of September 30, 2024 was reported at $1.79 million and Inventory was reported at $2.23 million. Continued and seasonal investments in scaling up promotional efforts contributed to increased advertising and marketing expenses in Q3 (see details below), which resulted in an adjusted EBITDA loss reported at $1.17 million compared to combined adjusted EBITDA loss of $0.38 million a year ago. Management anticipates that figure to improve over the coming quarters as the Company continues to realize incremental benefits from the partnerships mentioned above.

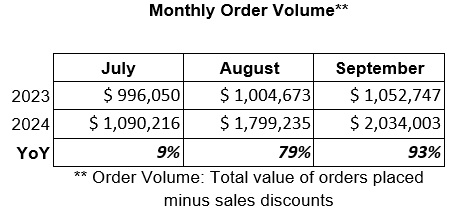

American Aires CEO Josh Bruni commented: “Achieving our highest ever order volume and sales in Q3 is our latest important milestone. That growth confirms our strategy and efforts in Q1 and Q2 were correct. It also reaffirms how all the inspiration and heavy lifting we put in during the first six months of a year bear their biggest results in Q3 and Q4, just like we saw in 2022 and 2023 – a model we’ll continue to use to scale our growth. Our order volume from October 1st through 25th, meanwhile, has also shown strong growth, totaling $2,004,516 (versus $813,059 in 2023), which represents an increase of 147% for the same date range YoY; Gross Margin percentage for the same date range was 62% (versus 63% in 2023). In the meantime, we remain committed to executing our long-term vision of efficiently increasing sales, hitting our growth targets, and building Aires Tech into a global and household brand that’s the clear choice in our market segment.”

Operational Highlights

The Company notes that the partnerships it forged in Q2 and Q3, together with the ability to create and leverage related content for the Company’s marketing strategy, helped drive order volume and sales growth in Q3/2024. Among other refinements to the Company’s organic marketing and advertising strategy, which is part of the ongoing effort to continue innovating and identifying incremental revenue opportunities, management notes that collaboration with Gray Wolf on the Public Relations front provided Aires with the ability to hone and amplify its customer-facing messaging. This collaboration also helped bring awareness of Aires’ technology and products to a wider audience, both within the technology and sports worlds.

The Company’s Q3/2024 results are consistent with management expectations. Given that the agreements mentioned above represent longer-term contracts varying from one year to several years, management anticipates that the Company should continue to realize related incremental benefits over the lengths of the contracts involved. Management also notes that each individual collaboration requires initial ramp up time to devise an effective strategy, create content, build, test, and optimize advertising campaigns, to reach the full potential of the investment in the way of order volume and sales growth.

The monthly Order Volume table below demonstrates how the Company’s ongoing advertising and marketing strategies have contributed to improving sales growth.

Financial Highlights

Gross Profit increased 61% YoY to $2.91 million from $1.81 million, and gross margin percentage was reported at 63% versus 62% in the same period last year.

During the three months ended September 30, 2024, advertising and promotion expenses increased 101% YoY to $2.31 million and marketing expenses saw an increase of 94% YoY to $1.14 million. Advertising expenses increased as the Company continued executing the strategy focused on strong sales growth and building Aires into a well-recognized brand in the EMF radiation protection segment. In addition, an increase in advertising expenses in September and October is part of the Company’s annual organic sales growth strategy leading into the seasonally strong holiday period. Management anticipates the benefit of those higher advertising expenses to be realized in Q4/2024 when the customers acquired in Q3/2024 tend to return during the holiday shopping season.

Management also notes that an additional factor driving advertising expenses higher during Q3/2024 is the ongoing political campaigning for presidential elections in the US. The higher media spend activity by political parties seems to be increasing advertising rates based on management and industry observations. A recent Axios study forecast that US election ad dollars spent in 2024 will grow to roughly $16 billion, up 31.2% compared to the last presidential election in 2020. Based on previous election years, marketing experts expect scarcer ad inventory and higher competition, while planning for related ad rate increases to ultimately reach 15-50% during the core six weeks of the election.

Marketing expenses increase is reflective of new partnerships and collaborations that the Company entered into during the course of year as well as the addition of some new vendors aimed at amplifying the value of those partnerships and collaborations.

Table 1: Condensed Consolidated Interim Statements of Financial Position (Unaudited) (in Canadian Dollars)**

About American Aires Inc.

American Aires Inc. is a Canadian-based nanotechnology company committed to enhancing well-being and environmental safety through science-led innovation, education, and advocacy. The company has developed a proprietary silicon-based resonator that protects against the potentially harmful effects of electromagnetic field (EMF) radiation.* Aires’ Lifetune products diffract EMF radiation emitted by consumer electronic devices such as cellphones, computers, baby monitors, and Wi-Fi, including the more powerful and rapidly expanding high-speed 5G networks. Aires is listed on the CSE under the ticker ‘WiFi’ and on the OTCQB under the symbol ‘AAIRF’. Learn more at www.investors.airestech.com. *Note: Based on the Company’s internal and peer-reviewed research studies and clinical trials.

For more information please visit https://airestech.com/pages/tech.

*Note: Based on the Company’s internal and peer-reviewed research studies and clinical trials. For more information please visit https://airestech.com/pages/tech.

**The Company notes that Q3/2023 “Combined sales” in Table 1, includes sales from August 29, 2023 through September 30, 2023 derived through the Aires-HUCK distributor partnership. The partnership was effective from August 28, 2023 through December 31, 2023. As such, even though Aires did not report gross sales from the partnership in this period to comply with IFRS accounting standards, the Company extracted the economic benefit from this partnership via the royalty streams. To make comparison of the quarterly results in 2024 fair and consistent, the Company is also providing the Combined Aires-HUCK figures, treating the revenue and expenses figures with the same accounting principles in an attempt to present the investor with figures that could be compared on the same basis. While the combined figures discussed above are non-IFRS measures, management believes they represent figures in the most comparable fashion.

On behalf of the board of directors

Company Contact:

Josh Bruni, CEO

Website: www.investors.airestech.com

Email: wifi@airestech.com

Telephone: (415) 707-0102

Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties. All statements other than statements of historical fact are forward-looking statements, including, without limitation, statements regarding future financial position, future market position, growth, innovations, global impact, business strategy, product adoption, use of proceeds, corporate vision, proposed acquisitions, strategic partnerships, joint ventures and strategic alliances and co-operations, budgets, cost and plans and objectives of or involving the Company. Such forward-looking information reflects management’s current beliefs and is based on information currently available to management. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “predicts”, “intends”, “targets”, “aims”, “anticipates” or “believes” or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions “may”, “could”, “should”, “would”, “might” or “will” be taken, occur or be achieved. A number of known and unknown risks, uncertainties and other factors may cause the actual results or performance to materially differ from any future results or performance expressed or implied by the forward-looking information. These forward-looking statements are subject to numerous risks and uncertainties, certain of which are beyond the control of the Company including, but not limited to, the impact of general economic conditions, industry conditions and dependence upon regulatory approvals. Certain material assumptions regarding such forward-looking statements may be discussed in this news release and the Company’s annual and quarterly management’s discussion and analysis filed at www.sedarplus.ca. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. The Company does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by securities laws.

No securities regulatory authority has either approved or disapproved of the contents of this news release. The Shares have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, or any state securities laws, and may not be offered or sold in the United States, or to or for the account or benefit of any person in the United States, absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy any common shares in the United States, or in any other jurisdiction in which such offer, solicitation or sale would be unlawful. We seek safe harbour.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this news release.